Billed Customers for Fees Earned for Managing Rental Property

Paid office salaries 2830. Paid creditors on account 1375.

Solved Transactions On April 1 Of The Current Year Andrea Chegg Com

Paid rent on office and equipment for the month 5000.

. Determined that the cost ofshow more content. Paid office salaries 3600. Paid office salaries 4000.

Paid creditors on account 1375. Billed customers for fees earned for managing rental property 9500. We also now have revenue.

Billed customers for fees earned for managing rental property 30800. Paid creditors on account 2290. Your customer hasnt paid you yet.

Assets account receivable. Paid office salaries 4000. Paid rent on office and equipment for the month 7000.

Sometimes they charge you a combination rate. Billed customers for fees earned for managing rental property 11250. Paid office salaries 4000.

Received cash from fees earned for managing rental property 10000. Billed customers for fees earned for managing rental property 30800. A combination rate means they charge you a percentage of rent fee or a flat fee depending on which is moreless.

Received cash from fees earned for managing rental property 18300. This means we are increasing Accounts Receivable by 30800. Pald automobile capuses including rental charges for the month 1380 and miscellaneous expenses 1800 h.

A basic percentage of rent fee and a flat rate. Billed customers for fees earned for managing rental property 7450. Increase in an asset decrease in another asset.

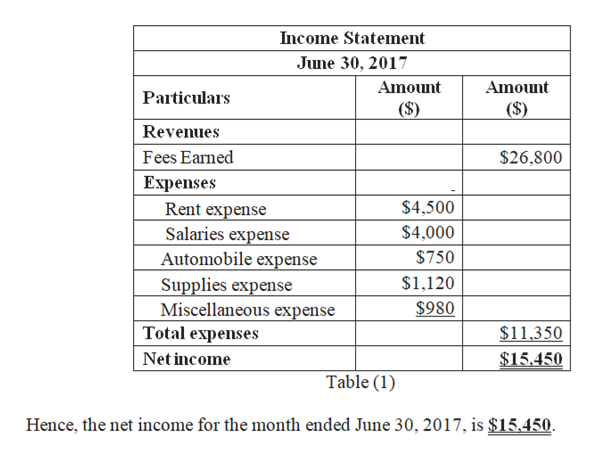

Billed customers for fees earned for managing rental property 3600. Paid automobile expenses including rental charges for the month 750 and miscellaneous expenses 980. Paid office salaries 2250.

Paid rent on office and equipment for the month 8300. When a transaction says billed it means you are creating an invoice to send to your customer. Paid rent on office and equipment for the month 5000.

Paid automobile expenses including rental charges for the month 1380 and miscellaneous expenses 1800. Billed customers for fees earned for managing rental property 30800. Billed customers for fees earned for managing rental property 5910.

Paid automobile expenses including rental charges for the month 1380 and miscellaneous expenses 1800. Purchased office supplies on account 1800. Therefore the cost of supplies used was 1060.

Paid automobile expenses including rental charges for a month and misc. Paid rent on office and equipment for the month 5000. Late service payment fee.

Paid rent on office and equipment for the month 4500. Paid creditors on account 1100. Paid automobile expenses for month 840 and miscellaneous expenses 900.

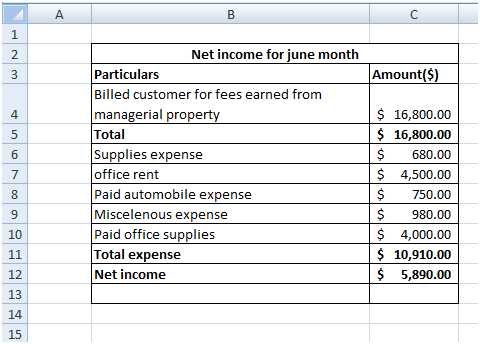

Paid automobile expenses including rental charges for the month 710 and miscellaneous expenses 350. Billed customers for fees earned for managing rental property 16800. Received cash from fees earned for managing rental property 22300.

Billed customers for fees earned for managing rental property 3600. Paid rent on office and equipment for the month 7000. Paid creditors on account 1250.

Billed customers for fees earned for managing rental property 16800. Any property management services that arent paid for by the due date may incur a fee ranging from 25 to 50. Received cash from fees earned for managing rental property 22300.

Billed customers for delivery services on account 58000. Paid automobile expenses for month 750 and miscellaneous expenses 1000. Billed customers for fees earned for managing rental property 5000.

The Standard Property Management Fees. Paid automobile expenses including rental charges for month 600 and miscellaneous expenses 300. Our revenue account is called Fees Earned.

Billed customers for fees earned for managing rental property. Paid automobile expenses for month 750 and miscellaneous expenses 1000. Paid rent on office and equipment for the month 7000.

Paid automobile expenses for month 890 and miscellaneous expenses 450. Billed customers for fees earned for managing rental property 3600. Paid rent on office and equipment for the month 4020.

Paid automobile expenses for month 750 and miscellaneous expenses 1000. Paid creditors on account 1490. Increase in an asset increase in a liability.

Any past-due invoices for the monthly property management cost may incur a small fee each day typically around 15 of the invoice. Paid office salaries 4000. Paid office salaries 1900.

Therefore the cost of supplies used was 1120. Received cash from fees earned for managing rental property 22300. Paid automobile expenses including rental charges for the month 750 and miscellaneous expenses 980.

Received cash from fees earned for managing rental property 8500. Paid automobile expenses including rental charges for the month 750 and miscellaneous expenses. Received cash from fees earned for managing rental property 9090.

Paid automobile expenses for month 840 and miscellaneous expenses 960. Cash fees earned 6750. Determined that the cost of supplies on hand was 680.

Received cash from fees earned for managing rental property 6750. Determined that the cost of supplies on hand was 1540. Received cash from fees earned for managing rental property 6750.

Management fees come in two forms. Billed customers for fees earned for managing rental property 30800. Billed customers for fees earned for managing rental property 16800.

Solved Transactions On April 1 Of The Current Year Andrea Chegg Com

Accounting Q And A Pr 1 1a Transactions

No comments for "Billed Customers for Fees Earned for Managing Rental Property"

Post a Comment